Gearing Up Your Giving: Getting Good with Your Wealth is Good for Your Giving

Mar 02, 2022Getting good with your wealth is good for your giving. This post is about how your relationship with your wealth connects with your approach to philanthropy.

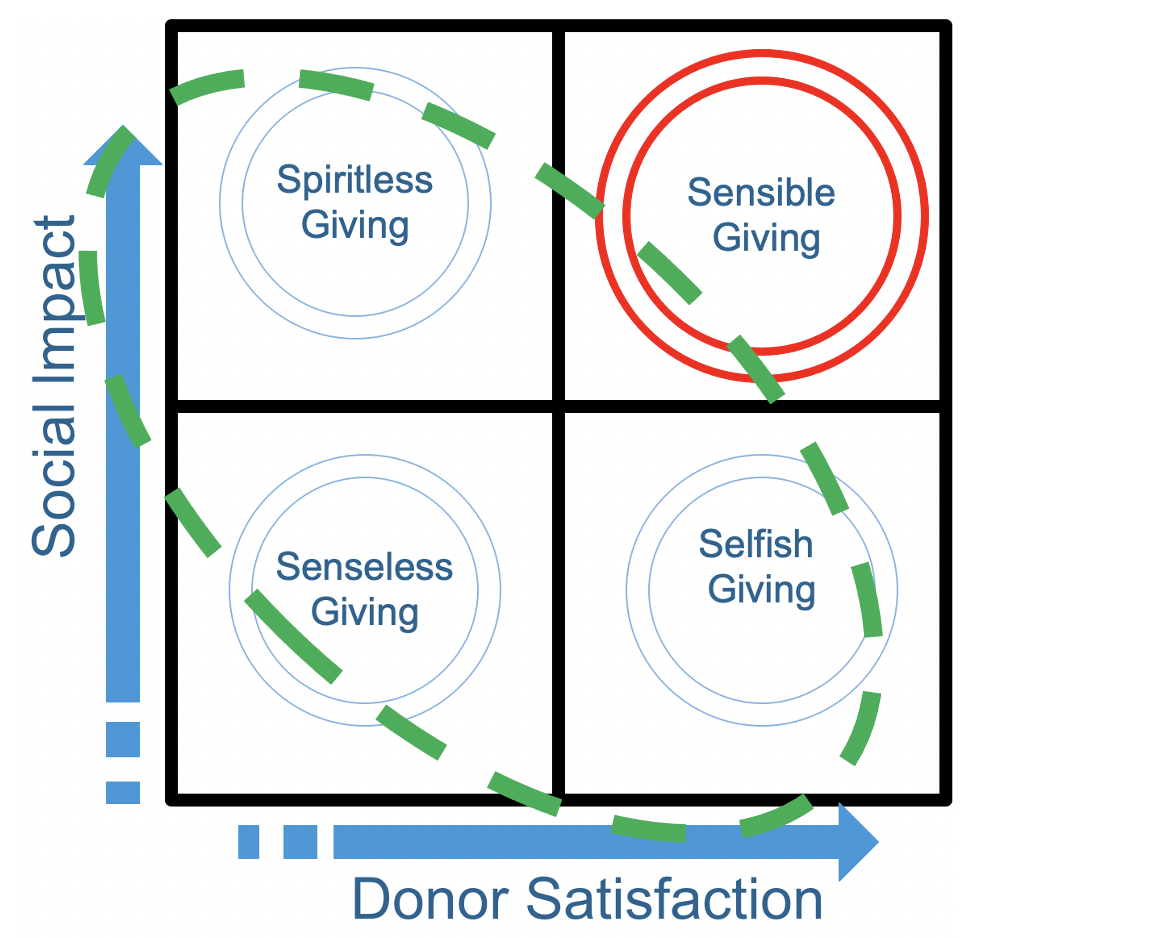

Four Types of Giving: A Self Assessment

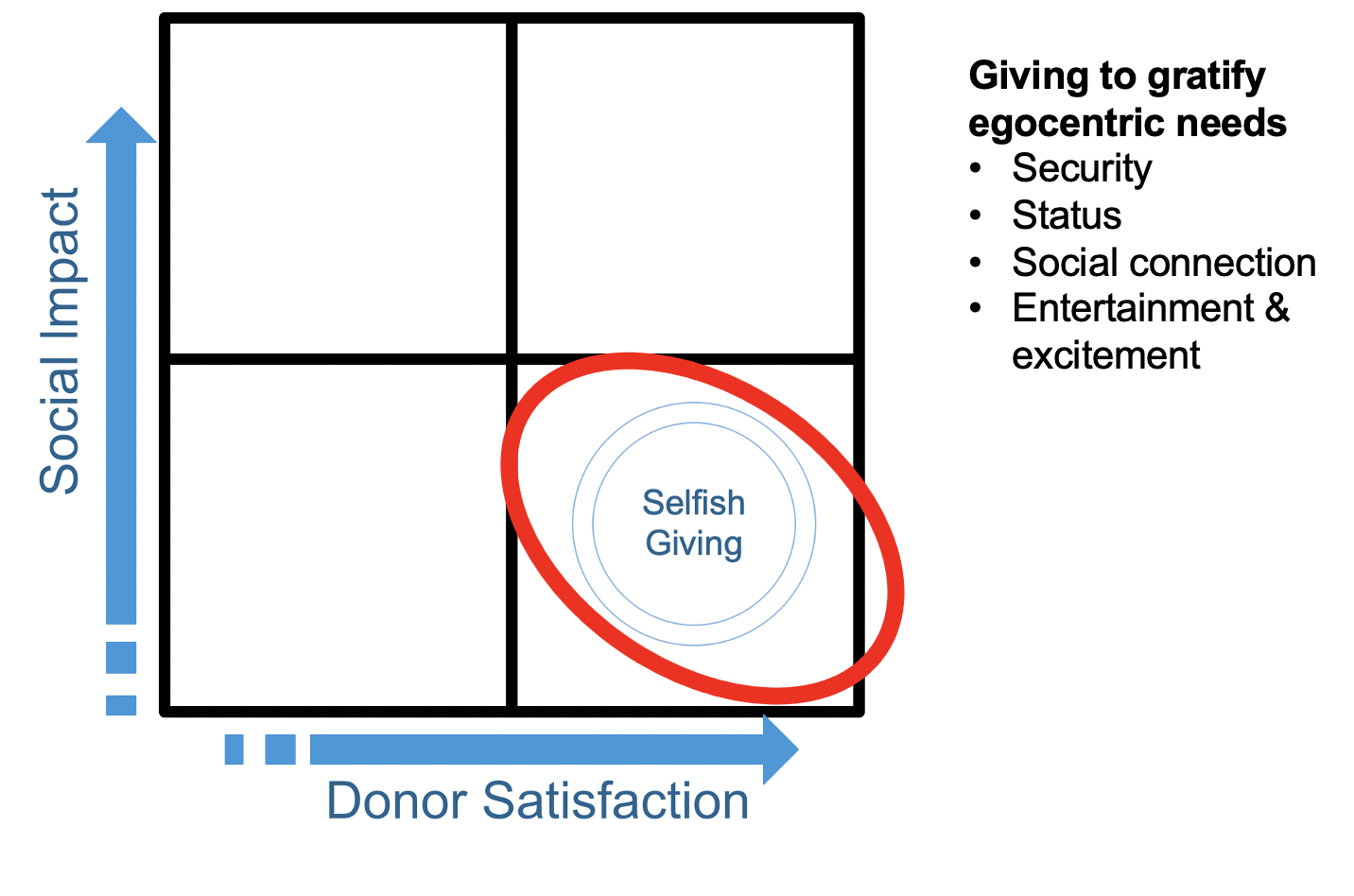

- Have you ever engaged in giving that you knew wasn’t helping those in the greatest need but was super important to you personally? Maybe supporting an educational institution your children attend or the capital campaign for someplace that already has a huge endowment?

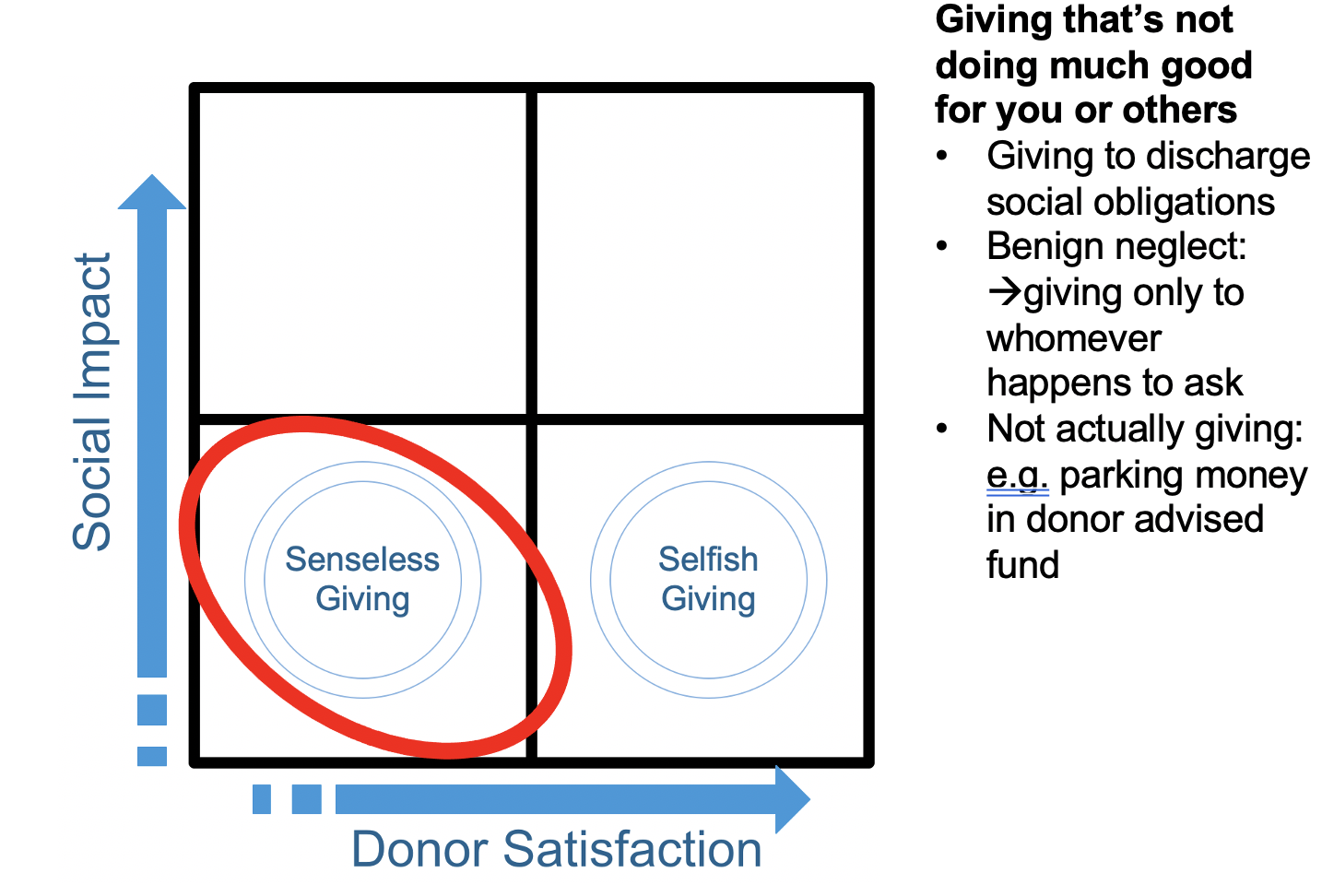

- Have you ever engaged in giving that you were pretty sure wasn’t producing much benefit for others and didn’t bring you much satisfaction either? Maybe this was giving that you were doing to satisfy a social obligation, or it was the pet project of another branch of the family. Or maybe you’ve had the experience of giving money to a donor-advised fund but haven’t gotten around to putting the money to work in the world by making distributions.

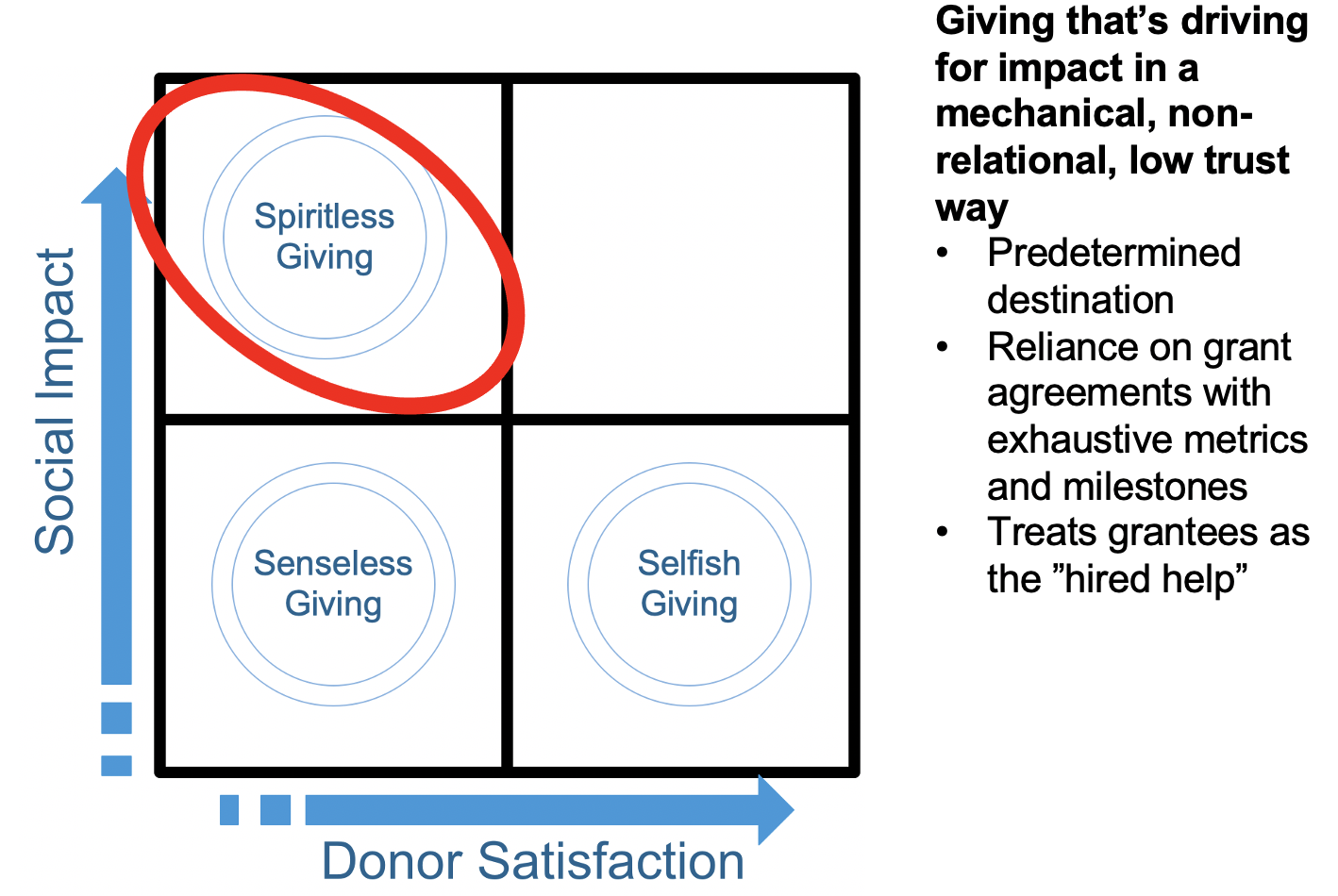

- Have you ever pushed so hard to maximize the impact of your giving that you’ve squeezed the joy out of it with performance contracts, metrics, and milestones—and still came away wondering if you were actually achieving the impact you were hoping for?

- How often have you hit the sweet spot in your giving, like grants that support people and organizations you really believe are making a difference in the world? How often do these successes bring you a deep sense of personal fulfillment and satisfaction?

Four Types of Giving: Which Zone Are You In Now?

Selfish Giving

Senseless Giving

Spiritless Giving

Sensible Giving: The Zone of Joyful Impact

Building a Healthy Relationship with Your Wealth Across Three Key Dimensions

- Your generational relationship to wealth

- Your cultural relationship to wealth

- Your goal orientation to wealth

As you think about your relationship with wealth across these three dimensions, there's a very helpful book, Stranger's In Paradise, by psychologist Dr James Grubman. He has worked with wealthy families over decades and developed a metaphor around adapting to affluence as an immigration journey to the land of wealth. Check out the video for a more detailed walk through this material. The land of affluence operates with very different cultural norms and expectations. One reason this metaphor is so helpful is that contrary to popular understanding, fully 80% of the people who are currently wealthy (let's say with above $5M in investable assets) moved from working or middle class origins into this level of affluence in their own lifetimes, Fewer than 20% of the wealthy in the U.S. inherited their wealth.

Your generational relationship with wealth

Are you a first generation immigrant--what is sometimes called G1 in philanthropic and wealth advising circles? Are you G2--meaning that your parents made the transition into wealth--if so you might have experienced this move to affluence during your childhood, you may have your own experience navigating this transition prior to becoming an adult. Or are you G3--meaning that you are the grandchild of the generation that first generated the family's wealth? If so, you have likely never experienced a different cultural and economic context.

Your cultural relationship with wealth

Grubman points out that the metaphor of immigration to the land of wealth points to three potential stances around how you relate to your wealth.

Are you avoidant? This is the stance that people take when they want to maintain their connection to middle class or working class cultural origins at all costs. This leads you to avoid engaging with your wealth in many respects--for example when you don't even tell your kids about the family's wealth out of fear that it will corrupt them and stunt their own sense of initiative and drive. This can lead to many unfortunate, unanticipated consequences for G2 and G3 because they end up not being prepared for navigating the world with a healthy relationship to their wealth.

Are you focused on assimilating into the world of wealth, being richer than rich and completely leaving behind the trappings of the working class or middle class background from which you came? This too can be problematic because it doesn't lead to developing a healthy relationship with your wealth that is grounded in enduring values across the generations.

Do you have an integration approach to your wealth, where you seek to integrate the best of the middle class or working class values which carried your family to the land wealth, while also recognizing that there are valuable new ways of operating within the land of wealth that allow you to make the most of your wealth in service to something larger than yourself?

Your goal orientation to wealth

There are three key stages here-

1. Aspire & acquire: this is where you are seeking to grow your wealth

2. Manage and maintain: this is where you are seeking to steward your family's resources once you have already reached a particular level of affluence

3. Distribute and dispense: this is when you have recognized that "you can't take it with you" and you are focused on making plans for sharing your wealth with others, whether within the family or through your giving

Much more on this in the video, but It's possible that you can occupy multiple stages simultaneously, particularly if you are an active entrepreneur who is still growing a business, while also managing existing assets and being engaged in estate planning and philanthropic giving. This is where it can be helpful to walk through an exercise around mapping your "philanthropic posture," including the challenging exercise of mapping out your lifeline for your intended net worth and your giving over the course of your lifetime. --more on that here.

Build a Healthy Relationship With Your Wealth to Avoid the Traps of Selfish, Senseless and Spiritless Giving

What's the bottomline? It's worth doing some work to map out your relationship to your wealth across these three key dimensions in order to gear up for giving that truly makes sense for you and for the world.

Stay connected with news and articles

Join us to receive the latest news and updates from our team.

Don't worry, your information will not be shared, and you can unsubscribe at any time

We hate SPAM. We will never sell your information, for any reason.